There is a news from GST council about the new rules of Goods and Services Tax. On Friday (October 6, 2017) the council has announced major changes to GST bill with major tax rate cut of various items. These changes are in the primary interest of exporters and small businesses. The new rules of GST are also favorable to a common man and in all sense, this move is expected to solve the hassles of GST process.

New rules of GST brings delight to exporters

With an intention to solve the liquidity problem faced by exporters, the GST council has announced six-month tax relied on exporters. It is said that returns for the month of July and August will be refunded through cheques from October 10 and 18 respectively. Thereafter for the rest of the fiscal, exporters will carry their business paying a nominal 0.1% GST.

Introduction of e-wallet

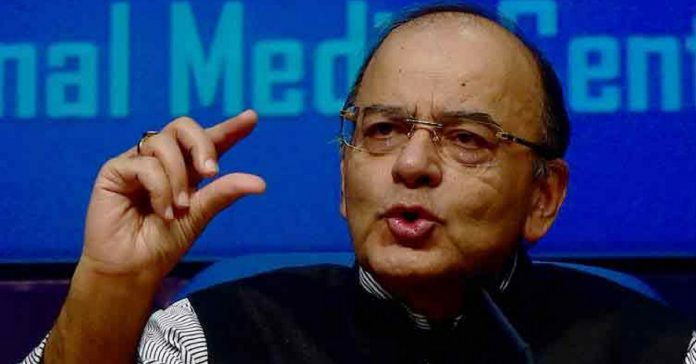

To address the problem of cash liquidity and the blockage in credit of exporters, The Finance minister has announced the setup of an e-wallet for exporters.

Arun Jaitley said, “As GST has no exemptions, for now, all exporters will be given an e-wallet. A notional amount will be given as advance refund and on the basis of this credit, firms can choose to pay IGST and GST. Also, refunds will be set off against this.”

He continued and confirmed the launch of e-wallet and is likely to be on April 1, 2018.

GST for Small and Medium Traders

The GST council has agreed to allow SME’s with a turnover of up to Rs.15 crore to file quarterly returns instead of monthly filings. This will benefit 90% of the taxpayers in the country, Arun Jaitley added. On the other hand, people who contribute 94-95% of the total taxes will continue to file monthly returns and pay taxes on a monthly basis as usual.

Cut in GST rate on 27 common use items

The council has some good news of common man with a cut in GST rates on 27 common use items.

Food items:

Mangoes sliced dried – GST rate cut from 12% to 5%

Khakra and plain chapathi – GST rate cut from 12% to 5%

Unbranded Namkeens – GST rate cut from 12% to 5%

Unbranded Ayurvedic, Unani, Siddha, and Homeopathy medicines – 12% to 5%

Stationery:

Poster Colour – 28% to 18%

Children toothpadte – 28% to 18%

Plastic waste, Rubber waste – 18% to 5%

Textile:

Nylon, Polymer, Acrylic – 18% to 12%

Man-made staple – 18% to 12%

Other items:

Cullet and Scrap of Glass – 28% to 18%

Letter clips, letter corners, paper clipsand – 28% to 18%

It is said that GST council has decided to simplify the registration and operationalization of TDS/TCS and it will be postponed until March 31, 2018. With the introduction of the e-bill system and composition schemes, the new rules of GST is aimed to make taxation system simpler in the country.